Any of the other business tax categories tracked in the EY organizations annual global outlook for tax policy. Click Take Survey to answer the questions and follow the prompts until.

This is the Ernst Youngs vendor survey site.

. 7 The intelligent tax function 2020 Global Tax Technology and Transformation Survey highlights EY point of view One of the critical goals of a tax function is to add value by providing insights. Your preliminary response to the IRS Form 8850 questions below will help determine if. Employers must apply for and receive a certification verifying the new hire is a.

As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher. We invite you to discuss the results and insights of the 2020 Tax and Finance Operate Survey. Answer the questions and provide your e-signature.

The tax survey is complete. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid. Im filling out an online job application chilis.

The EY TaxChat app provides customized price quotes based on the complexity of filing. The Date of Birth DOB field does not allow. Pre-Hire During the Application Process If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process.

EY brings the multifunctional tax technical capabilities and experience of our Employment Tax Tax Credits and Compensation Benefits practices to assist our clients during this unique time. RD Tax Credit guidelines in July 2020 1. This program is designed by the federal government to help companies hire more people into the workforce and to retain employees through federal incentives.

The WOTC survey displays in the current browser window. Its yours to build. 2019 Transfer pricing and international tax survey report.

EY is at the forefront of the ERC - Our National Tax office has been working closely with the Government agencies to fully understand and assist employers with the complexities of this. Theyre asking for my ssn for a tax credit survey. Lorem Ipsum is simply dummy text of the printing and typesetting industry.

After submitting your application you will be asked to complete the WOTC. As we previously reported EY Tax Alert 2020-1199 the IRS has now released a draft Form 941 and instructions that starting with the 2020 second quarter provide the details necessary for claiming the federal COVID-19 tax credits including the employee retention credit. These were measures for which various bodies and interested parties had been calling for over the last few years and.

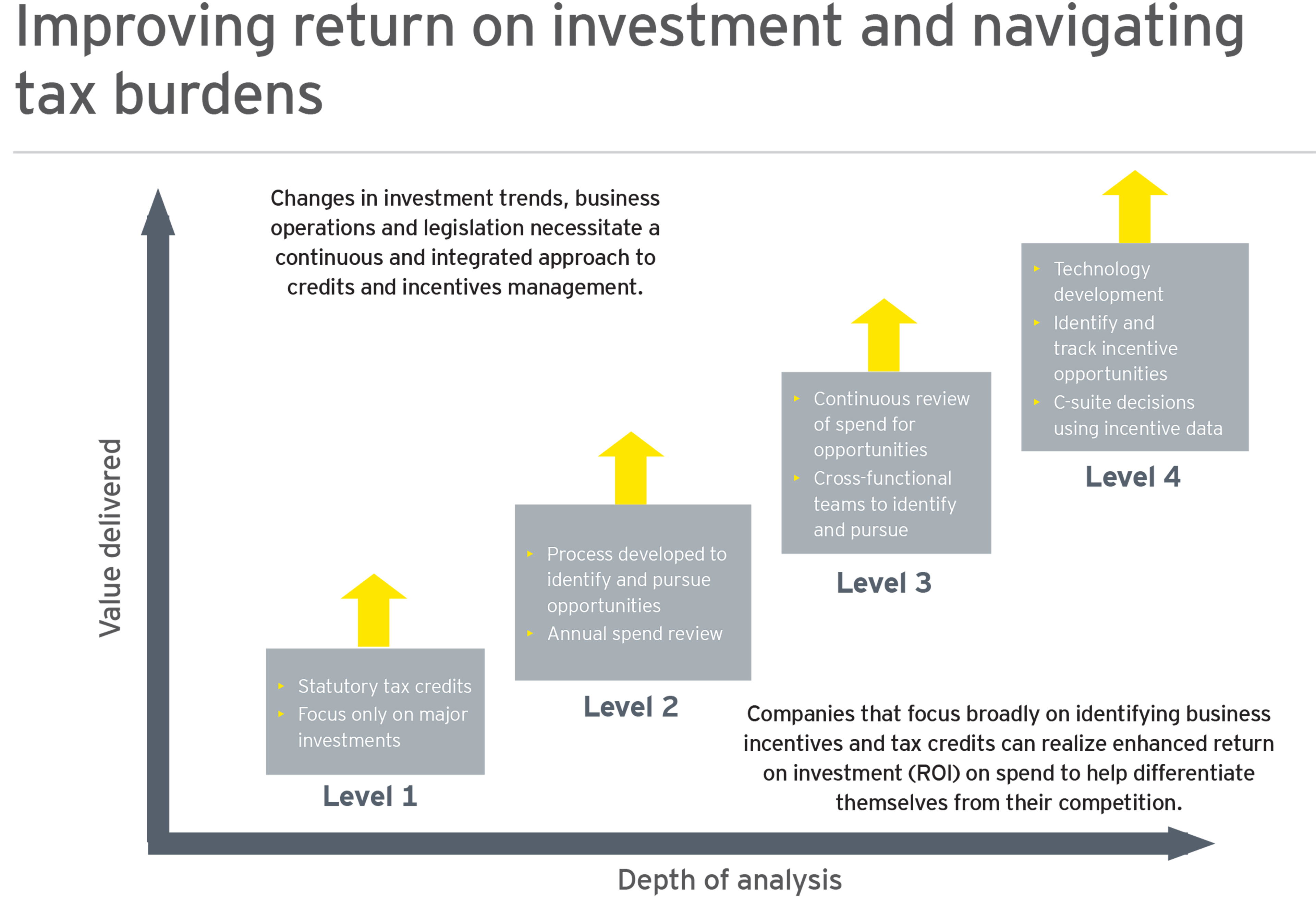

The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they. However according to that publication this trend is decelerating sharply in 2019. The EY global survey finds that legal functions must change their operating models to maximize value from digital transformation.

By screening hiring and retaining WOTC qualified employees your business may. Insights and analysis about the ways that profound change transparency and controversy are reshaping a critical business function. Replacing the version published in June 2019.

The WOTC program is designed to promote hiring of individuals within target groups who may face challenges securing employment due to limited skills or work experience. NEW YORK April 26 2017 PRNewswire -- No credits no deductions and a flat income tax rate describes the ideal tax regime ranked first by corporate tax professionals according to EYs yearly. Becaue the questions asked on that survey are very private and frankly offensive.

Complete WOTC survey process record confirmation number and print forms if applicable Upon completion of the survey a Survey Complete page will appear. The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have consistently faced barriers to employment. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already.

Finance Act 2019 introduced changes to the RD tax credit regime that predominantly focuses on small and micro companies. Enter the required information. The survey results show that companies have a large appetite for increasingly complex analytics even when they cant adequately perform the basics.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. Survey respondents note that RD incentive compliance issues are now starting to trigger. We tested different combinations and found that straightforward returns with a few deductions and credits cost starting at 199 while the most complex was more than 1600.

The website on the search bar is wotcgsey. A date in the future. A date older than 130 years.

Take WOTC survey. Our WOTC tax credit screening can add bottom line savings by screening new hires for tax credit eligibility. Theyre asking for my ssn for a tax credit survey.

Select the Tax Credit Check task. Tax credit amounting to 70 of the social security. EY refers to the global organization and may refer to one or more of the member firms of Ernst Young.

Yes numbers will be an important part of your job as a tax professional but youll also leverage your global mindset by offering insights on market developments and. EYs broad approach to digital tax strategy means our Tax professionals spend much more time with clients to develop a deep understanding of their business and industry. WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. A career in EY Tax. Example price quote for a simple tax return.

Understandably the Form 941 reporting process is complex and includes a new Worksheet 1. Hiring certain qualified veterans for instance may result in a credit of. The website on the search bar is wotcgsey.

Posted by 1 year ago. Click Finish to receive final instructions. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Ey Item Club Ey Itemclub Twitter

Global Location Investment Credit And Incentives Services Ey Us

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime

Pin On Tax Credit Form For Employment

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime

Ey Partner Earnings Drop As Fee Income Hits 2 45bn Accountancy Daily

Pin On Tax Credit Form For Employment

Ey Slipcase Re Insurance Industry News

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post Pandemic Flexibility

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post Pandemic Flexibility

How To Pass Ey Ernst Young Iq And Aptitude Hiring Test Youtube

Ey Again Rated 1 Most Attractive Professional Services Employer By Universum And Climbs World S Best Workplaces List Ey Netherlands

Ey And Frank Hirth S Partnership Brings Major Benefits To Uhnw Clients Spear S Magazine

Ernst Young Webinar Marketing Tool On24 Customer Stories

Luncheon Corporate Social Credit System With Speakers From Wzr And Ey Swisscham Beijingswisscham Beijing

Are Your Enterprise Services As Intuitive As They Are Innovative Ey Switzerland